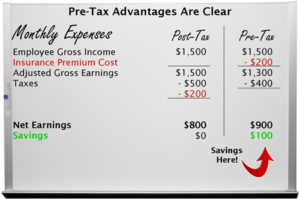

It’s that wonderful time of year when we have the pleasure of filing our taxes, but it doesn’t have to be dreaded. How does a bit of tax savings sound? More specifically, the 20-25% tax savings on your health benefit plan. Whether it’s a Flexible Spending Account, a Health Reimbursement Arrangement or a Health Savings Account, all have tax-saving advantages.

Flexible Spending Accounts provide tax saving advantages for both the employee and the employer. Both parties save on taxes and therefore increase their spendable income. Employee’s pretax contributions are not subject to federal, social security taxes and state taxes in most states. Employers will save on the employer portion of FICA, FUTA and Worker’s Compensation insurance premiums.

Health Reimbursement Arrangements provide valuable tax relief to business owners and their employees. Employer tax advantages include reimbursements of qualified claims being tax-deductible, and knowing the maximum expense related to the health care benefit. For employees, reimbursements may be tax free for qualified medical expenses. Employer contributions can also be excluded from the employees’ gross income.

Health Savings Accounts are tax-free financial accounts that are designed to help individuals save for future health care expenses. They are combined with High Deductible Health Plans (HDHP). You will save on premiums because of the high deductible. When you deposit saved premiums into your HSA account, you will save on taxes because HSA deposits are tax-deductible. Simply put, the money goes into the HSA account tax preferred, grows in the account tax preferred, and when used for health care, it comes out tax preferred.

As you file your taxes this year, contemplate on any of the tax advantages you may have received from your benefit plan. If you have questions about your current health plan or would like further information regarding tax-savings advantages, please contact us.