PCORI is a non-profit entity that compares the effectiveness of medical treatments. The Affordable Care Act imposed a tax to fund the institute which applies to health flexible spending arrangements and HRA plans. The very first PCORI reporting requirement was back in July of 2013.

The ACA is still the law of the land, and unless something changes within the next few months, it is still a requirement to file if your health plan is applicable.

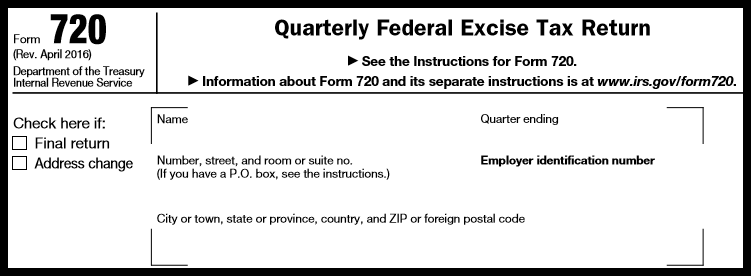

The fees for PCORI are required to be reported annually on the 2nd quarter Form 720, and are based on the average number of lives covered under the policy or plan. According to the IRS website, “The Form 720 will be due on July 31 of the year following the last day of the policy year or plan year. Electronic filing is available but not required. Payment will be due at the time the Form 720 is due.”

For policy and plan years ending on or after October 1, 2016 through December 31, 2016, the fee per covered life for the July 31, 2017 filing will be $2.26, up 9 cents from last year’s fee.

For policy and plan years ending on or after January 1, 2016 through September 30, 2016, the fee per covered life is $2.17.

As of right now, the remaining due dates for applicable plans to file will be July 31 of 2017, 2018 and 2019.

Flyte HCM does not file Form 720 on your behalf, but we are happy to offer assistance with any questions you may have. Please check with your accounting firm for filing Form 720 if the tax applies to your company’s plan.