Once set to expire in 2019, the Patient-Centered Outcomes Research Institute (PCORI) fee was renewed for the next 10 years. This fee, paid every year by July 31 until 2029, is sent to the Internal Revenue Service to fund the Patient-Centered Outcomes Research Institute, an independent nonprofit that develops research to guide patients and caregivers when making healthcare decisions.

As an employer, it’s important to know if you’re responsible for paying PCORI fees. And that depends on which types of healthcare plans you offer to your employees. If you provide a traditional healthcare plan, the insurance company pays the fee. But if you provide self-insured group health plans, such as an ICHRA or QSEHRA, you as the employer pays. However, certain plans, such as HSAs, military health plans, Medicaid, Medicare, CHIP, insurance for employees working outside the US, and vision or dental standalone plans, are exempt from the fee.

The amount of the PCORI fee is based on the average number of participants covered, and below we provide three methods for calculating this fee.

How to Calculate PCORI Fees

The PCORI fee is calculated by multiplying the average number of lives covered during a policy or plan year by the applicable dollar amount. The dollar amount is adjusted each year to reflect inflation.

The PCORI regulation provides three methods for calculating the fee:

- Actual count: Add the number of employees covered on each day of the plan year and divide by the number of days in the plan year.

- Snapshot: Choose one or more days during each calendar quarter, add the covered lives on those dates, and divide by the number of dates used.

- Form 5500: Sponsors who offer only individual coverage take the number of participants reported at the beginning of the plan year, plus the number reported at the end of the plan year and divide by two. Plan sponsors who offer coverage other than individual coverage must take the number of participants reported at the beginning of the plan year, plus the number reported at the end of the plan year.

PCORI Fees Quick Guide

- Download Form 720.

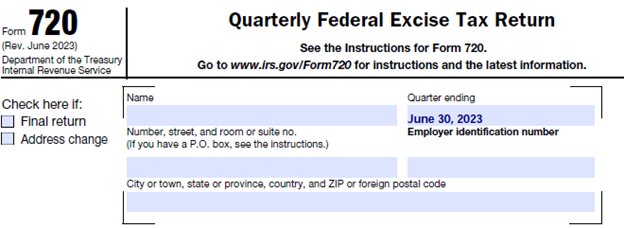

- Complete the header information on page 1:

*Quarter ending will always be June 30 of the relevant year.

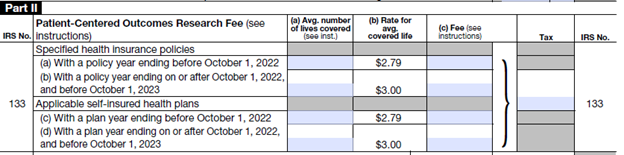

- Complete line 133 and enter the total:

*The average number of lives for the plan year can be calculated by adding the number of employees covered on each day of the plan year and dividing it by the number of days in the plan year.

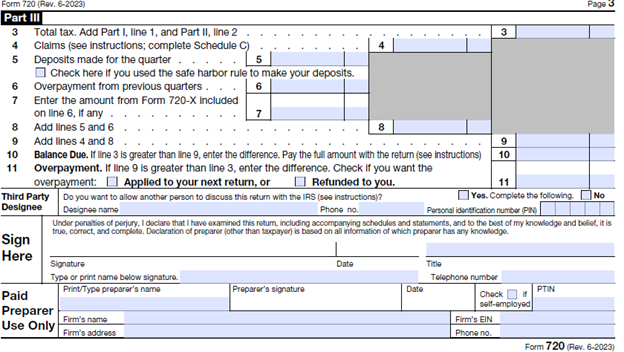

- In Part III, complete lines 3 & 10 and sign:

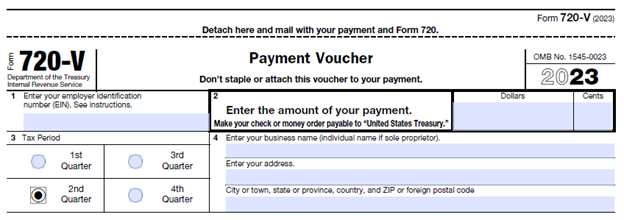

- Complete the Payment Voucher (at the bottom of form 720):

- Send completed form, payment voucher, and check to:

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0009

Still have questions? Download our PCORI Fees Guide, visit the IRS instruction page on form 720 or contact Flyte.