Employers around the country are reviewing their benefit options and preparing for Open Enrollment.

One of the most common questions we help our clients with is how to manage another increase in healthcare. This year is especially important because fluctuations in the economy and labor markets have put a spotlight on overall cost management. Many employers and their staff shout “Hurray for HSA Day” after only their first year with an HSA. They are that important to those with high health insurance costs.

So, how will HSAs, HRAs, and ICHRAs make a positive impact during this challenging time?

Need a change?

If you or someone you know is struggling with increasing group premiums, contact Flyte today. We are experts in integrating HSAs with both ICHRAs and Traditional HRAs to maximize savings.

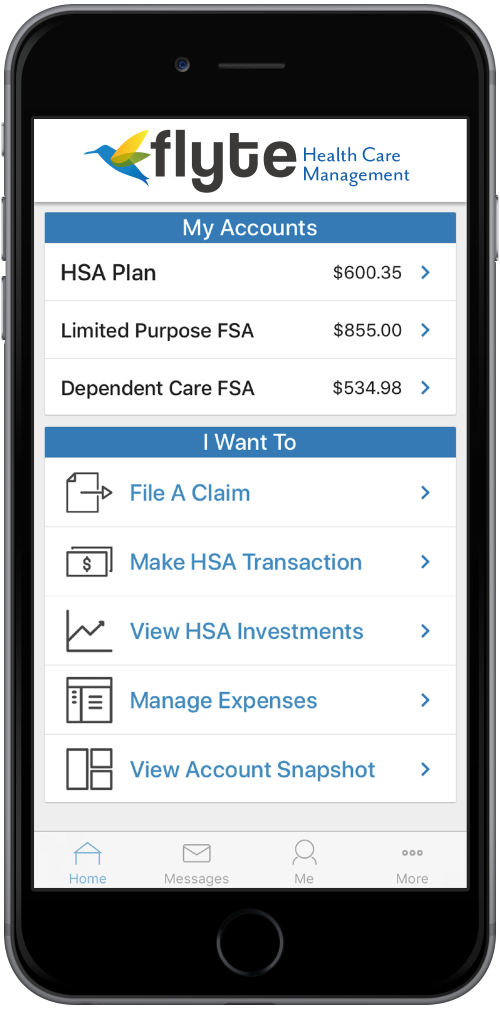

Ask us how the Flyte Mobile App combines all of your employee’s Health Accounts into one single user-friendly experience.