HRA

Health Reimbursement Arrangements

Traditional Benefit

Health Reimbursement Arrangements

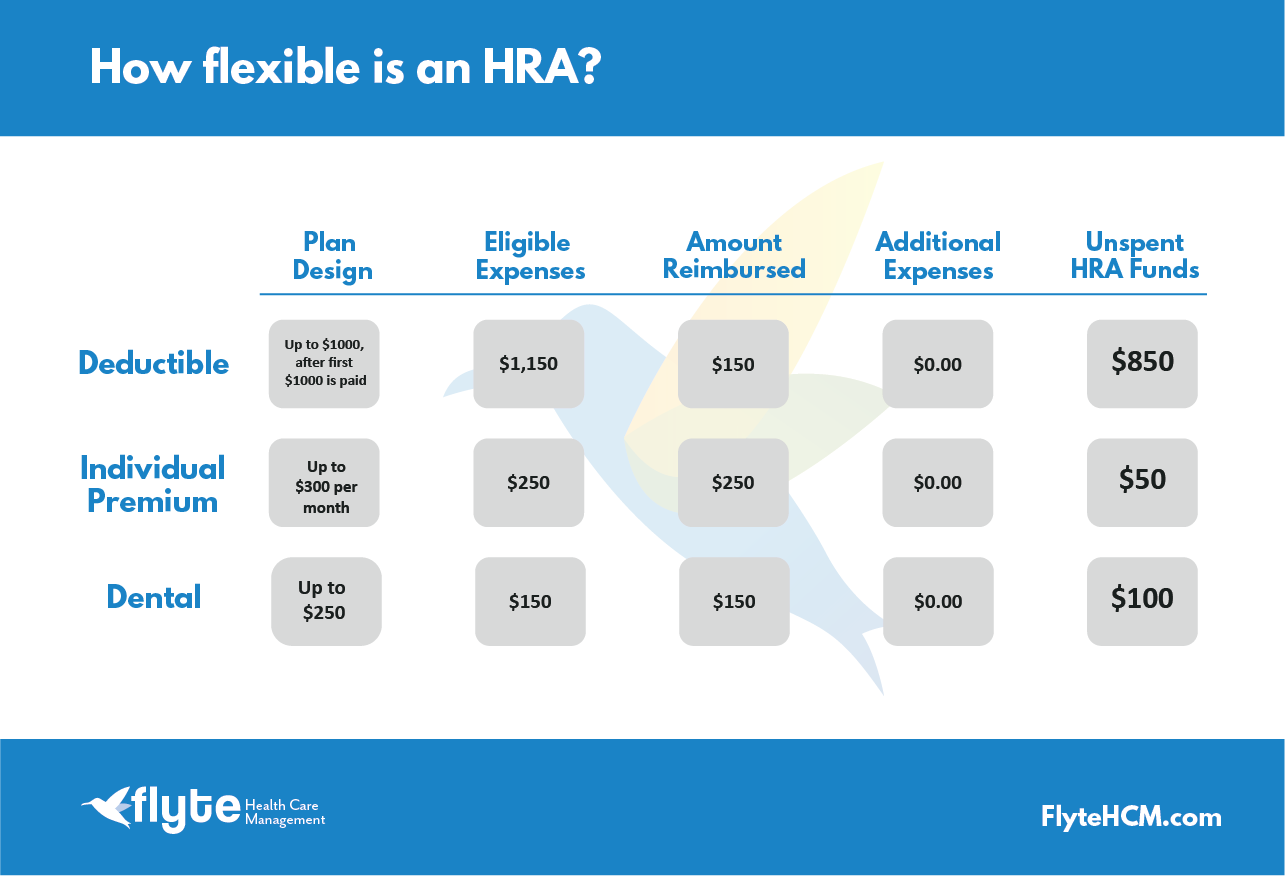

A Health Reimbursement Arrangement is an employers’ promise to pay should certain criteria be met. For example, a common HRA Plan Design is one that reimburses up to $1000 per year towards deductible expenses. In the deductible example, if the employee only incurs $500 worth of deductible expenses then no HRA money will be distributed.

Modern Benefit

Individual Coverage HRA

An Individual Coverage HRA (ICHRA) is an HRA specifically designed to reimburse employees for medical insurance they have purchased on their own. It’s a tax-free employee benefit where the employer sets their own budget on how much health benefits will cost, and employees choose coverage that is specific to their needs.

Strategic Benefit

Dental / Vision HRA

Did you know that HRAs can also reimburse for certain non-medical expenses tax-free? Dental and vision expense HRAs have been popular for many years due to their simplicity, ease of use with employees, and positive impact to employees.

Frequently Asked HRA Questions

HRA Administration

Flyte is a full service HRA administrator

“Can my employees turn their receipts into HR instead of hiring Flyte to manage our claims?” We get this question often. The quick answer is yes, employers are not required to hire an administrator to manage their HRA. We aren’t shy about that because hiring an administrator should have a clear value to the employer, and their goals. We would love to talk with you about yours.

Simple and Affordable

Flyte simplifies health account administration with industry leading innovators utilizing the most cutting edge benefits technology available. Our mission is to simplify your HRA so you can focus on your day.

Here is what it takes to provide quality HRA Administration:

Services

Company